So far, 2023 has been the year of AI. However, it’s easy to forget that one of the most talked about topics just last year was around the idea of the “metaverse”. Facebook made a big splash when it renamed itself “Meta” in late 2021 as it doubled down on its investments in VR and AR through its Reality Labs division. However, unlike ChatGPT, the metaverse is not easily accessible to a broad audience and is often talked about alongside dystopian-looking images of avatars that fall into the uncanny valley. While Zuck may be a few years early, VR and AR certainly has a future in our lives and it’s a topic worth demystifying.

What is VR and AR?

The terms VR and AR are often used interchangeably but represent two very distinct experiences. In a nutshell, VR is a fully immersive experience, blocking out the physical world and placing the user in an entirely simulated environment. AR, on the contrary, superimposes virtual objects onto the real-world view, enhancing our physical surroundings rather than replacing them.

Virtual Reality: Yesterday, Today, and Tomorrow

By now I’m sure most folks are familiar with the Oculus (Meta) Quest headsets and have seen ads for the to-be-released Apple Vision Pro. VR experienced its moment in the spotlight a few years back but the technology has generally fallen short of what many predicted and hoped for. Lets take a look at why and where VR has found utility:

Beyond a rather expensive price tag for the headset, the consumer-facing VR industry has historically faced a classic chicken-and-egg conundrum: content is needed to drive user adoption, but studios have been hesitant to invest in producing content for an unproven user base. Another substantial reason for the lack of widespread adoption is the limitations around the hardware itself and its isolating nature. The experience, while novel, often induces eye strain and motion sickness with additional discomfort caused by the pressure and weight of the unit on the head and face. Moreover, VR is fundamentally a single player experience that transports the user away from the real environment and other (real) people in the vicinity. In recent years, the industry has made significant strides in making VR headsets lighter, cheaper, and more powerful. However, headsets today are still not light enough, cheap enough, or powerful enough for the average person to be interested in strapping one to their head for any longer than an hour.

Outside of the consumer realm, VR has found utility in various enterprise settings where the isolating nature is less of an issue. For instance, medical students can leverage VR to conduct medical simulation training in a way that is low stakes but realistic. Engineers can use VR to visualize digital twins in 3D and Bank of America is even using VR to train its bank tellers in virtual robbery scenarios. However, the value proposition today is more of a “nice to have” rather than a “must have” since use cases reside primarily in cost centers (i.e., training) rather than profit centers.

Nonetheless, the VR industry has carved out its niches in the gaming and training segments and will likely continue to see greater adoption as the technology continues to improve and become more accessible to a broader market.

Augmented Reality: Present Constraints and Future Possibilities

AR, in comparison to VR, is still in its early stages. The technology is still in the midst of the development stage with various challenges in designing hardware capable of a true AR experience that is also practical for its intended use cases. These challenges include developing slim and practical near-eye displays (NEDs) and providing sufficient battery life and processing power while remaining lightweight for extended wear. Consequently, the current headsets on the market have a bill of materials in the thousands of dollars. As such, consumer AR experiences today are primarily confined to smartphone and tablet applications where virtual overlays are displayed through the camera feature.

In the enterprise world, AR applications have been piloted using the Microsoft Hololens and Magic Leap headsets at companies such as Airbus, Audi, Lockheed Martin, and L’Oreal. Unlike VR, AR headsets do not confine its wearers to a virtual world and users are able to interact with what is in front of them, from an assembly line to a lab. This key difference is also what makes AR a more practical application in the enterprise setting — especially in the industrial, manufacturing, and pharmaceutical sectors. Use cases such as overlaying digital instructions for workers to make quick repairs or improve accuracy in complex assembly situations allows for reduced downtime and errors, enhancing the efficiency of the entire operation.

Earlier this year, the US Army even tried to spend $400M on Hololens headsets (which was shut down by Congress) for the Integrated Visual Augmentation System (IVAS) which provides soldiers with a heads-up display to show real-time map data and mission objectives, information such as range and windspeed, and enhanced night vision. However, the project is still developing with recent field tests causing soldiers to develop headaches and nausea, which are more than an inconvenience in combat.

While the technology still has a ways to go before it becomes mainstream and accessible to a broader market, the breadth of possible AR applications across enterprise and consumer sectors make it one to watch.

VR and AR in Canada

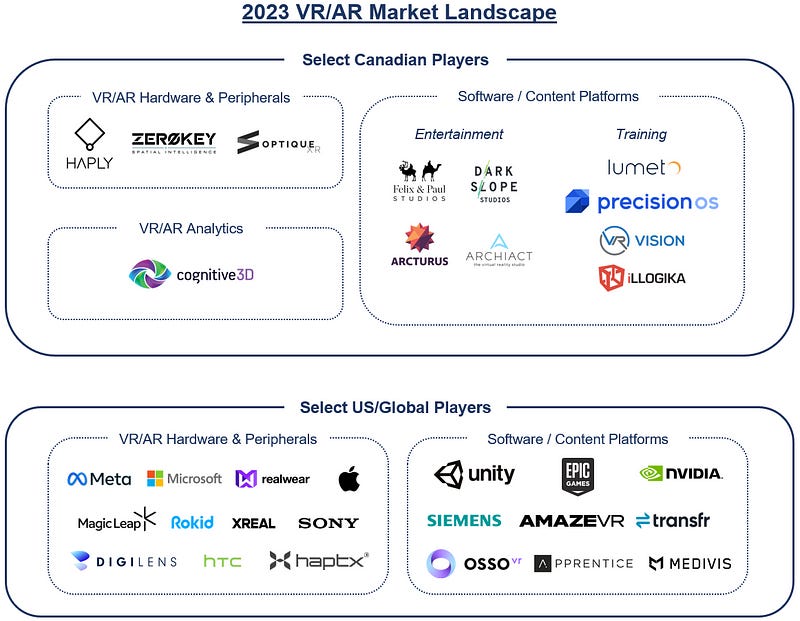

While the technology is still relatively new, Canada is home to a budding VR and AR ecosystem that spans across both hardware and software. Across the country, companies such as Toronto-based Lumeto and Vancouver-based PrecisionOS create VR/AR learning modules specifically designed for the medical field while Montreal-based Haply Robotics produces haptic tools that work with VR and AR software to bring another level of realism to the experience. The technology is truly something that needs to be experienced to be appreciated fully. Personally, I’m a firm believer that VR and AR will one day fundamentally augment many enterprise workflows and find mainstream consumer adoption in one form or another. For now, I’m excited to witness the ecosystem evolve and seek opportunities to invest in players disrupting the way we work, live, play and learn!

About Maverix Private Equity:

Maverix seeks to make significant minority investments in disruptive companies with proven business models who have potential for rapid growth. We seek investments primarily in Canada and the US with a focus on the Consumer Retail, Healthcare & Wellness, Financial Services, Transportation & Logistics, and Work, Live, Play & Learn sectors. Our investment size ranges from US$20mm to $100mm+.